Figure AI Blocks Unauthorized Stock Sales Amid $39.5B Valuation

Investors eager to buy or sell Figure AI stock on secondary markets have run into a major roadblock. The robotics startup, founded by Brett Adcock, has sent cease-and-desist letters to multiple secondary brokers, demanding they stop marketing its shares without authorization. As Figure AI’s valuation surges toward a projected $39.5 billion, questions are rising around how investors can access private shares, the legality of secondary market trading, and the company's efforts to control its equity sales. If you’re wondering whether you can buy Figure AI stock before an IPO, or how secondary markets factor into high-demand private companies, here’s everything you need to know.

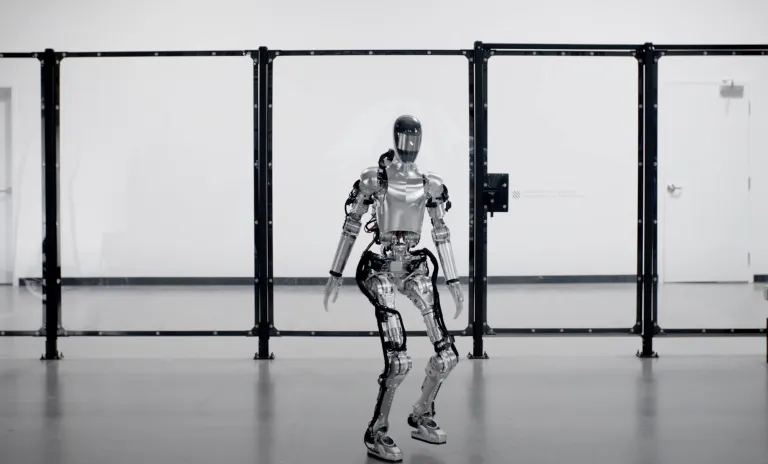

Image Credits:Figure AIWhy Figure AI Is Sending Cease-and-Desist Letters to Brokers

Following Brett Adcock’s bold claim that Figure AI had become the "most sought-after private stock" on secondary markets, the company has taken swift legal action. Several brokers confirmed to TechCrunch that they received cease-and-desist letters after Bloomberg’s February report about Figure's ambitious $1.5 billion fundraising round at a staggering $39.5 billion valuation—fifteen times higher than the $2.6 billion valuation just a year earlier.

A Figure AI spokesperson explained that the company routinely issues these letters to brokers marketing its shares without board approval. “We do not allow secondary market trading without board authorization and will continue to protect the company against unauthorized activity,” they said in a written statement.

Private stock sales require delicate handling, especially at this scale. Unlike public stocks, shares of private companies like Figure AI aren't freely tradable. Buyers and sellers often turn to secondary markets to cash out or invest before a public offering—but only with strict company oversight.

Why Figure AI's Move Matters for Secondary Market Trading

Secondary markets have become essential for employees and early investors looking to realize gains before an IPO. They often offer services like loans secured by startup shares, making liquidity accessible without a company event. However, when startups like Figure AI clamp down, it signals a deeper concern: controlling valuation optics and market perception.

Sources in secondary trading suggest that one reason Figure AI is tightening its grip is fear of lower-priced share sales. If existing shareholders sell at prices below the $39.5 billion mark, it could dampen enthusiasm for Figure’s upcoming primary fundraising efforts. Maintaining a high valuation is critical not only for attracting investors but also for securing favorable loan terms, merger opportunities, and customer partnerships.

How Secondary Markets View Figure AI’s Crackdown

Brokers on the receiving end of the cease-and-desist letters believe companies like Figure AI worry that secondary sales reveal real-time market sentiment—sentiment that may not align with internal hopes. Lower-priced secondary trades could undermine a company’s fundraising story.

Sim Desai, founder and CEO of Hiive, a major secondary shares marketplace, weighed in: he believes companies often see secondary markets as a threat when they could actually be an asset. “Secondary market trading can build excitement for a primary raise," Desai told TechCrunch. However, if share sales lag, it's usually a price and valuation issue—not a lack of investor interest.

Secondary market trading remains a double-edged sword for unicorn startups. It can either validate sky-high valuations or expose them to uncomfortable scrutiny.

Figure AI's Legal Challenges and Public Relations Strategy

Beyond the stock trading issue, Figure AI has recently made headlines for another reason: disputes over media coverage. Articles touting Figure’s partnership with BMW have drawn backlash from the company itself, which has threatened legal action over alleged inaccuracies.

This aggressive stance on both unauthorized stock sales and public narratives shows Figure AI’s intense focus on managing its image—critical for a company approaching a potential IPO or major funding event. Protecting brand value, perceived technological advancement, and internal morale are paramount at this high-growth stage.

What Investors Should Expect Next

As Figure AI prepares for its next capital raise, investors face uncertainty about when—or if—they’ll be able to participate in secondary sales. Without board authorization, shareholders can neither freely sell their holdings nor expect easy liquidity options.

For those eyeing opportunities, it’s clear: until Figure AI hosts an IPO or a sanctioned tender offer, buying or selling its shares will remain tightly controlled. Investors should also closely watch how upcoming funding rounds affect secondary trading dynamics. If the $39.5 billion valuation holds or even grows, Figure AI could become one of the decade’s standout private investments—but only for those who can secure access.