Nvidia China Revenue Forecast Exclusion Signals Long-Term Strategy Shift

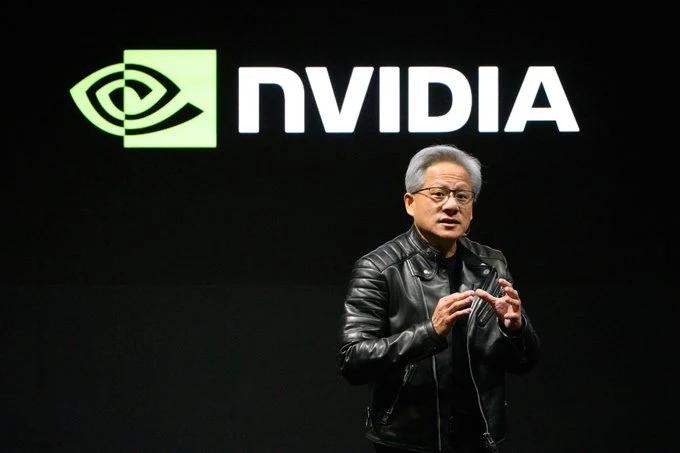

Nvidia has officially excluded China from its revenue and profit forecasts, signaling a major shift in how the AI chip giant approaches one of its historically largest markets. The move comes amid persistent U.S. government restrictions on high-end chip exports to China, particularly Nvidia’s powerful H20 AI chips. With little optimism for regulatory relief, Nvidia CEO Jensen Huang made it clear that the company no longer considers China a reliable component of its financial planning.

Image Credits:Akio Kon/Bloomberg / Getty ImagesThis adjustment to the Nvidia China revenue forecast isn't just a numbers game—it reflects a broader geopolitical recalibration. As tensions between the U.S. and China continue to influence global supply chains and tech regulation, Nvidia is positioning itself to prioritize markets less vulnerable to political volatility. Let’s explore what’s behind this strategic pivot and how it affects Nvidia’s future growth outlook.

Why Nvidia Is Revising Its China Revenue Forecast

Nvidia’s decision to leave China out of its profit projections is a direct response to U.S. government export controls on advanced chips. Back in April, the Biden administration enforced stricter licensing requirements for AI chips sold to China, including Nvidia’s H20 chips—its most sophisticated offering. These controls effectively blocked billions in potential revenue, with the company projecting an $8 billion shortfall in Q2 due to lost Chinese sales.

CEO Jensen Huang, speaking to CNN, acknowledged that any easing of restrictions would be welcome—but highly unlikely. Nvidia’s pivot isn’t based on wishful thinking. Instead, it reflects a grounded recognition that U.S.-China tech decoupling is here to stay. And while Chinese sales were once a core pillar of Nvidia’s revenue, the company is no longer betting on that market to deliver consistent results.

Nvidia’s Global Strategy Without China

Removing China from its revenue forecast doesn’t mean Nvidia is retreating—it’s refocusing. The company is aggressively expanding into regions that support U.S. trade policy, including the European Union, Southeast Asia, India, and the Middle East. AI infrastructure demand continues to soar globally, and Nvidia is well-positioned to capitalize on that with high-performance GPUs, cloud partnerships, and autonomous systems.

By adjusting its strategy, Nvidia reduces geopolitical risk while enhancing investor confidence. The revised Nvidia China revenue forecast is a sign that the company is maturing in how it handles uncertainty, offering more predictable performance for shareholders. Furthermore, it reflects Nvidia’s growing belief that long-term AI adoption outside of China will be sufficient to drive sustainable growth—especially in industries like healthcare, finance, and robotics.

Long-Term Implications of Excluding China from Nvidia Forecasts

The long-term implications of the revised Nvidia China revenue forecast are significant. First, it sets a precedent for other tech companies that rely on cross-border chip sales to rethink their dependence on sensitive geopolitical relationships. Nvidia’s stance may prompt its peers—like AMD, Intel, and even ARM—to follow suit in building more resilient business models.

Second, it invites China to accelerate efforts to develop indigenous AI chips, potentially giving rise to a new breed of domestic competitors. However, catching up to Nvidia’s performance benchmarks is no small feat, especially as U.S. sanctions limit access to the latest semiconductor manufacturing technologies. Meanwhile, Nvidia remains dominant in the global AI compute space and is channeling resources toward next-gen GPU innovation.

Ultimately, removing China from its financial forecast may seem like a loss, but it could end up being Nvidia’s biggest strength. By focusing on aligned markets, reinforcing supply chain security, and fostering deep R&D, Nvidia is not just surviving the current tech cold war—it’s redefining its global footprint.